Funding Your Tech Vision: A Comprehensive Guide For Entrepreneurs

Embarking on a tech entrepreneurial journey is an exhilarating experience, but to turn your visionary concept into reality, you’ll need more than just passion—you’ll need financial fuel. This guide is your compass through the intricate terrain of funding options, offering insights and strategies to secure the resources your tech venture requires.

1. Grasping Your Funding Needs:

Vision Clarity: Before delving into the world of funding, ensure your tech venture’s vision is crystal clear. Articulate your development scope, market potential, and the problem your product aims to solve.

Financial Assessment: Conduct a meticulous evaluation of your financial requirements. Consider development costs, operational expenses, and a buffer for unforeseen challenges.

2. Types of Funding:

Bootstrapping: Launching your venture with personal savings or revenue generated by the business. It provides autonomy but limits scalability.

Angel Investors: Individuals investing their personal funds in startups. Seek those aligned with your industry or interests.

Venture Capital (VC): Funding from investment firms in exchange for equity. VC funding often comes in multiple rounds—seed, series A, B, and so on.

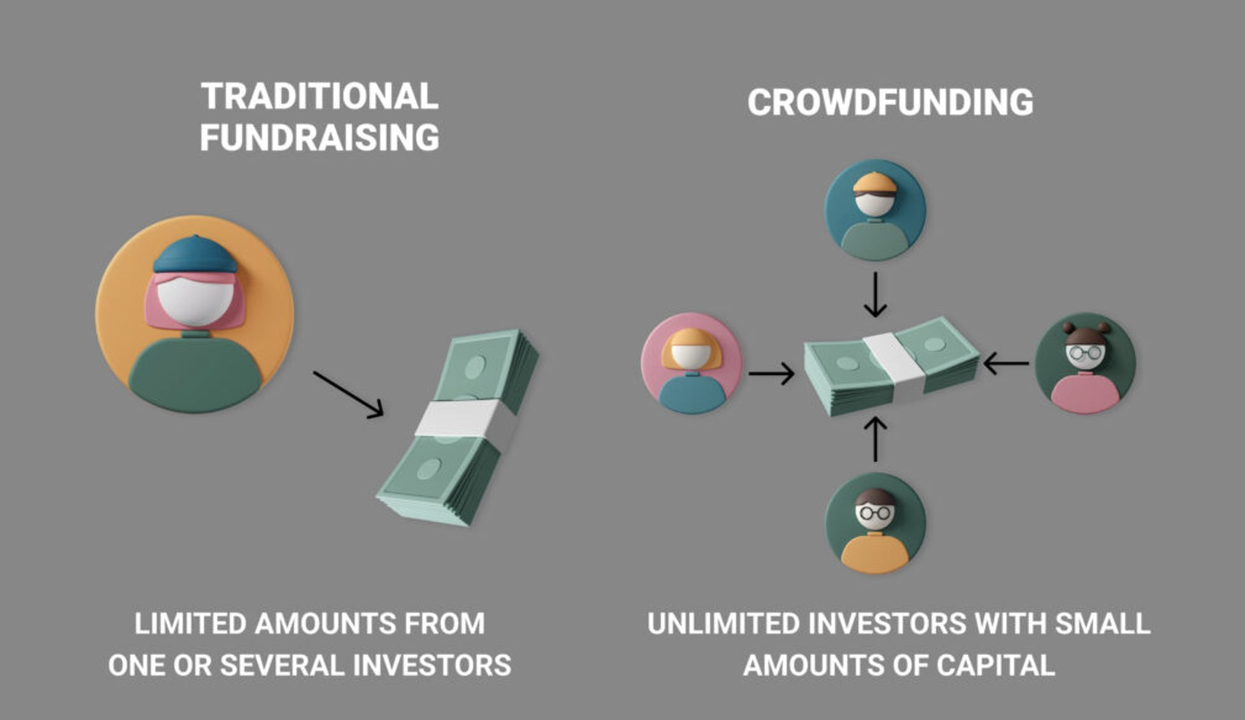

Crowdfunding: Source funds from a large number of individuals through platforms like Kickstarter or Indiegogo.

Corporate Investors: Leverage partnerships with established corporations willing to invest or provide resources in exchange for innovation.

Government Grants and Subsidies: Explore grants or subsidies offered by government agencies to support tech innovation.

3. Crafting a Compelling Pitch:

Storytelling Matters: Craft a narrative that resonates with potential investors. Clearly articulate the problem, your solution, and the market opportunity.

Financial Projections: Provide realistic financial projections. Investors want to see a clear path to profitability.

Team Showcase: Highlight your team’s expertise and commitment. Investors invest in people as much as ideas.

4. Due Diligence:

Know Your Investors: Research potential investors thoroughly. Understand their portfolio, industry focus, and the value they bring beyond capital.

Legal Guidance: Seek legal advice to navigate the complexities of term sheets and agreements. A clear understanding protects your interests.

5. Managing Investor Relations:

Communication: Maintain transparent and open communication with investors. Regular updates foster trust and confidence.

Advisory Board: Consider forming an advisory board with experienced individuals who can provide strategic guidance.

6. Adapting to Investor Feedback:

Iterative Approach: Be open to refining your pitch based on feedback. Adaptability demonstrates a commitment to improvement.

Building Relationships: Investors appreciate founders who value their input. Cultivate relationships beyond the initial pitch.

7. Mitigating Risks:

Diversification: Explore multiple funding sources to mitigate dependency on a single channel.

Financial Prudence: Exercise financial discipline. Prioritize essential expenses and ensure optimal resource allocation.

8. Navigating Challenges:

Resilience: Tech entrepreneurship is a rollercoaster. Stay resilient in the face of challenges and setbacks.

Pivoting: Be open to pivoting your business model if market dynamics or feedback warrant a change.

9. Celebrating Successes:

Milestones Recognition: Acknowledge and celebrate milestones. It boosts team morale and investor confidence.

Scaling Wisely: As funds come in, scale your operations strategically. Avoid rapid expansion without a solid foundation.

10. Continuous Learning:

Industry Insights: Stay updated on industry trends, market shifts, and emerging technologies. Continuous learning is key to staying competitive.

Networking: Build a robust network within your industry and among investors. Learn from peers and seek mentorship.

Navigating the funding landscape is a challenging yet rewarding aspect of building a tech startup. By understanding your needs, exploring diverse funding avenues, and fostering strong investor relationships, you’ll be better equipped to transform your tech vision into a thriving reality. Remember, it’s not just about securing funds; it’s about building a sustainable and impactful venture. Here’s to the journey ahead! 🚀